The Federal Government of Germany has decided on a package of measures that includes a temporary reduction of the VAT from 19% to 16%.

The aim is to revive the economy, which has been weakened by the corona-related restrictions.

From July 1st, 2020 and limited until December 31st, 2020 the regular VAT rate will decrease from 19% to 16% and the reduced tax rate from 7% to 5%.

A separate process was created in the ingenious software to map the temporary VAT reduction.

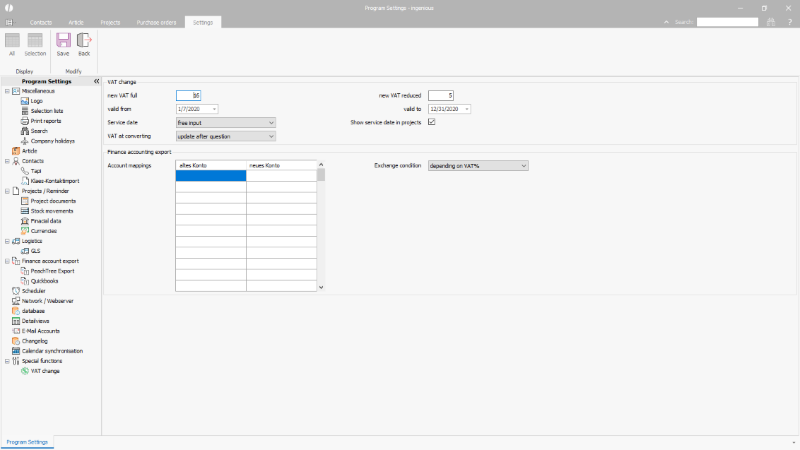

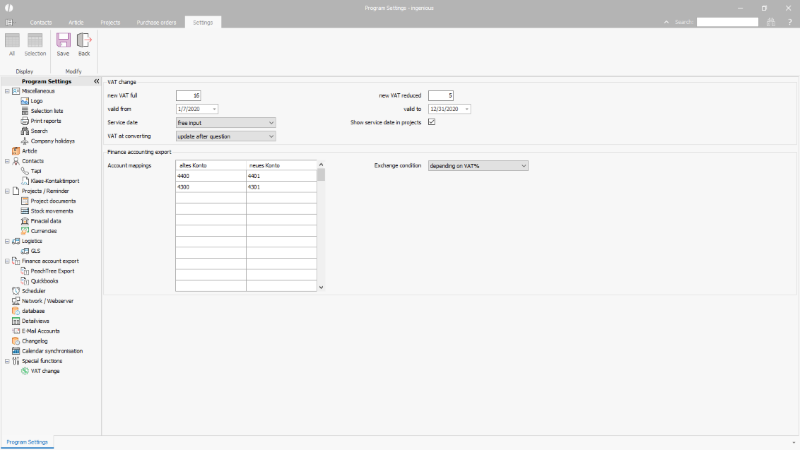

In the program settings / special functions / VAT change, the new VAT rates with their validity can be stored.

Example configuration of the reduced VAT |

All new project documents created in the validity period are automatically calculated with the associated tax rates.

In addition, it can be configured what should happen to existing projects when they are switched to the next status.

The following parameters can be set:

| Service date |

The application of the VAT rate is based on the service date, i.e. when the service was provided or completed.

| ||||||||||

| Show service dates in projects | For the options of the service date "Free input", "Convert to invoice" and "Convert to delivery note", you can determine whether the service date should be displayed separately in the project. | ||||||||||

| Bind service date to field | To determine the valid VAT rate, one of the 17 available project date fields can also be used, e.g. the date of delivery, if this is used in the company process. | ||||||||||

| VAT at converting |

When converting a project document, the VAT can either: - be updated after question: If the VAT rate of the original project differs from the currently valid VAT rate, the user is informed. With confirmation he can recalculate the project. |

Use cases

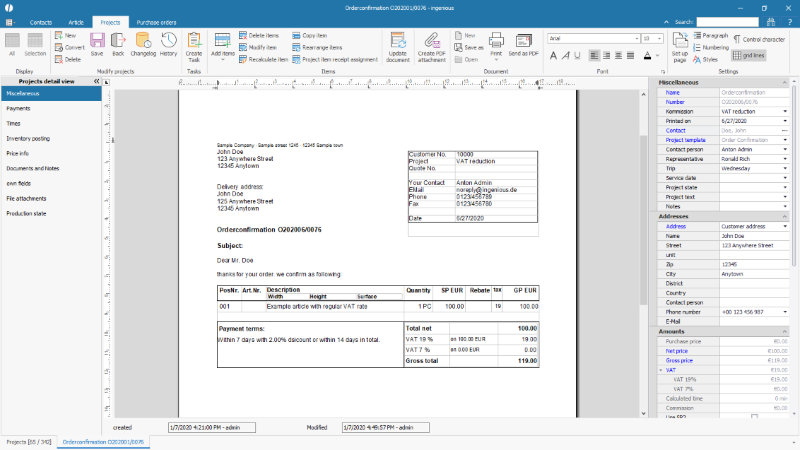

An order created before the VAT reduction is delivered and billed after the VAT reduction

An order created in June was charged with 19% VAT, the service date has not yet been set.

Basis project with "old" VAT |

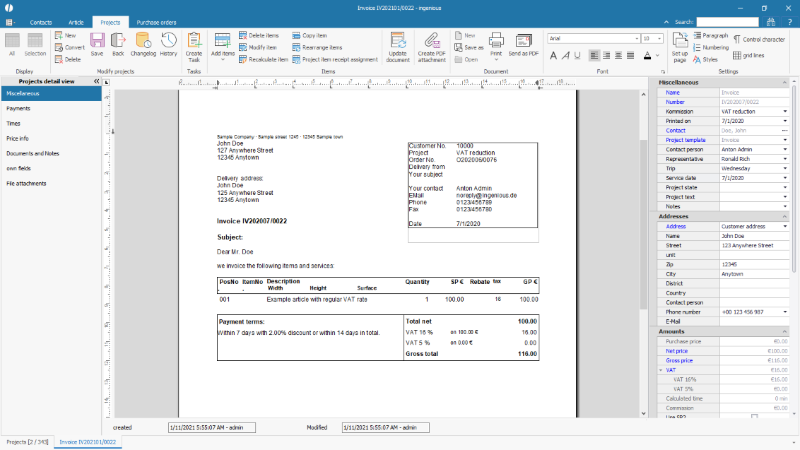

The invoice will be issued with delivery on July 1st, 2020.

With the appropriate configuration, the project is automatically recalculated with the reduced VAT rate.

Automatic adjustment of VAT |

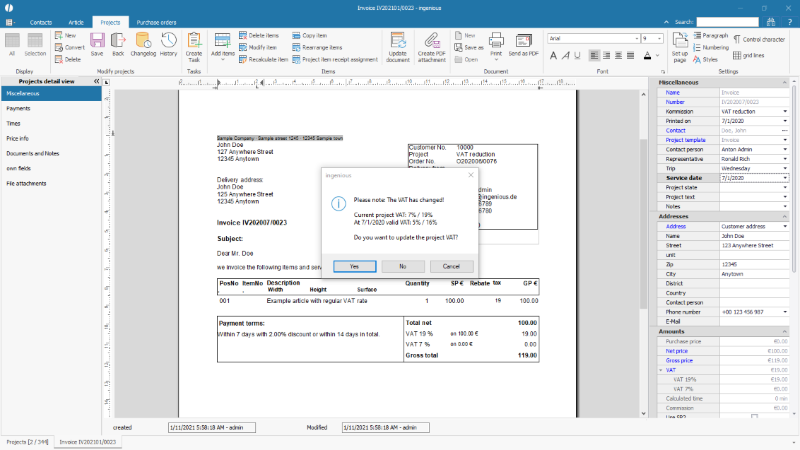

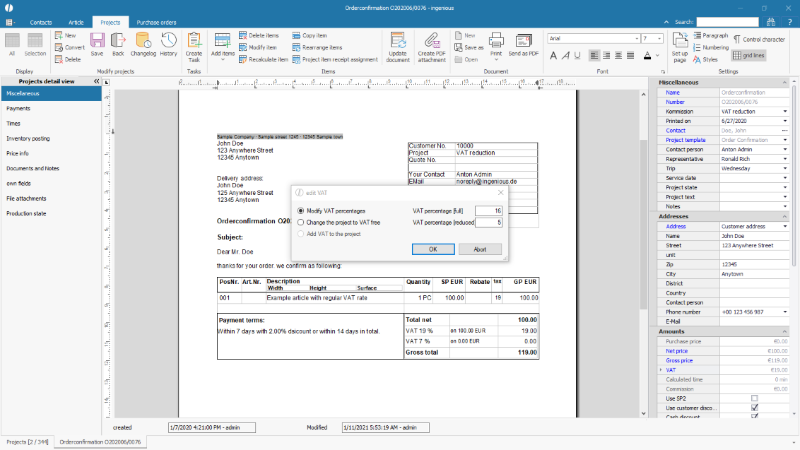

Or the user determines whether the project should be recalculated.

The VAT rates saved in the original project and the VAT rates that differ on the service date are displayed.

Question for recalculation of the VAT |

An order is created before the VAT reduction with a known service date after the VAT reduction

If it is already clear on the day the order is received that the service date falls within the period of the VAT rate reduction, the order with the reduced VAT rate can be created before the actual VAT reduction (a service date must be configured.)

After the service date has been set, the valid VAT rates are loaded into the project, if configured.

Manual VAT adjustment in the project

If it is configured that the VAT should be adjusted manually in the project, the VAT rates can also be loaded and edited if necessary by double-clicking on the blue field label "VAT".

Order documents can also be updated and sent to customer again.

Manual change of the VAT in the project |

Special processes

Combine projects

Some special processes cannot be taken into account by the program.

For example, it is not possible to mix old and new VAT rates on one document.

This means that projects that are billed collectively using the "combine projects" function must first be sorted to the service date (or period) and must be billed separately.

Partial and final invoices

Partial invoices can be agreed for long-term projects in order to spread the payments over the entire service period.

The partial invoices can then show different VAT rates or the VAT rate can differ when the project is completed.

The final date of the complete service is decisive for determining the correct VAT rate.

In the standard final invoice in the ingenious software the total net amount is reduced by the net discount and the applicable VAT is added to the remaining amount.

For a correct representation of the mixed VAT rates an individual project template has to be created, as described in the chapter Final invoice.

Individual processes

Invoices can also be created automatically using individual scripts. These scripts may need to be adapted to use the correct VAT rates.

In this case, please get in touch with your contact person of the Ingenious team.

Financial export

In the various financial exports for transferring sales to an accounting program such as DATEV, the gross amounts of the invoices will be exported to the corresponding sales accounts.

The VAT rate is configured in the accounting programs for the respective sales account so that the correct net amount is automatically posted.

As a rule, the accountancies have created new separate sales accounts to differentiate between gross bookings with 19% or 16% VAT in the accounting programs.

This is to be configured in the ingenious program settings as follows from the first export with separate sales (usually after the export of sales from June 2020):

In the tab "Special functions / VAT change" in the table "Account mappings" for "old account" the account for booking the sales with 19% VAT is entered.

The account for the 16% sales must be entered as the "New account".

The same procedure is used if sales are posted with the reduced VAT rate.

In the case of differentiated accounts, e.g. separated by customer type and / or type of goods, the old (19%) and the new (16%) must be compared for each permitted account.

Configuration of sales accounts with reduced VAT |

Please clarify with your accountancy individually how the issue will be handled there and coordinate any individual adjustments with us before the first invoice with the reduced VAT rate is exported.